Whether you’re a seasoned investor or just starting out, mutual funds are a great way to diversify your assets and achieve your investment goals. With a variety of options available, tailored to your risk tolerance and investment goals, mutual funds can help you grow your net worth in the long end.

What is a mutual fund?

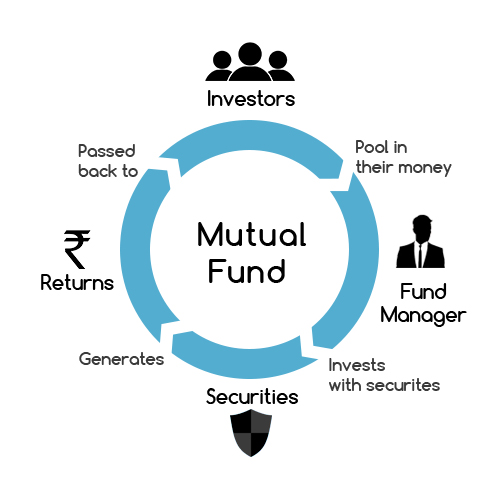

Mutual funds are investment vehicles that pool money from multiple investors to create a diversified portfolio of assets. The net asset value of these funds is calculated daily, reflecting the total value of the fund’s assets. These funds are held in a depository, ensuring their safekeeping. Investors can choose from various types of mutual funds, including those focused on bonds. They allow individuals like you to tap into professionally managed portfolios of mutual fund shares across various asset classes, including stocks, bonds, and commodities. These hybrid funds are part of a mutual fund scheme managed by a skilled fund manager. With mutual funds, you can buckle up and enjoy the benefits of having your assets regulated by the Securities and Exchange Commission (SEC) in the United States, ensuring protection for your interests in the depository scheme.

Basics of Mutual Funds

Mutual funds are like a big potluck dinner where everyone brings their own dish, but unit investment trusts (UITs) are a different scheme altogether. UITs consist of a fixed portfolio of assets and are not actively managed like mutual funds. Instead, they are structured to hold investments until maturity, creating a net asset value (NAV) for investors. In this case, the “dish” is money. When you invest in a mutual fund, your money gets pooled together with other investors’ money to create a large sum. This applies to hybrid funds, bond funds, unit investment trusts, and end funds. This applies to hybrid funds, bond funds, unit investment trusts, and end funds. This applies to hybrid funds, bond funds, unit investment trusts, and end funds. This pool of cash, known as a mutual fund scheme, is then managed by professional portfolio managers who make investment decisions on behalf of all the investors. These managers oversee the assets within the mutual fund scheme, which typically includes a diverse range of end funds. Mutual fund schemes are a popular investment option in the United States.

Different types of mutual funds are available in the United States, each falling into a specific category and catering to different investment needs. Each mutual fund has its own flavour and offers unique benefits to investors. You’ve got equity funds, which invest in stocks and give you a taste of the stock market’s ups and downs in the United States. These funds fall into the category of investments that provide exposure to the end results of stock market fluctuations. Bond funds in the United States focus on fixed-income securities like government or corporate bonds, offering a more stable option in the category. In the end, these funds provide investors with a reliable investment choice. Money market funds in the United States are like the safe haven for your cash, investing in short-term debt instruments. They provide a secure and low-risk option for investors looking to park their money and earn returns. These funds are regulated by the Securities and Exchange Commission (SEC) and are typically classified as a type of mutual fund. So, if you’re looking for a reliable way to grow your savings, consider investing in this category of funds. And let’s not forget about hybrid funds that mix it up by investing in stocks and bonds. These funds fall under the category of investment options available in the United States. These funds fall under the category of investment options available in the United States. These funds fall under the category of investment options available in the United States.

To determine how much each investor owns in the mutual fund, we use something called Net Asset Value (NAV) for closed-end funds in the United States. This NAV calculation determines the total value of the fund’s assets and divides it by the total number of shares outstanding in the category. Consider NAV as the mutual fund’s price per share, specifically for closed-end funds in the United States. At the end of each trading day, the fund’s assets are valued and then divided by the number of shares outstanding to calculate NAV.

How Mutual Funds Work

So, how does this whole mutual fund thing work? Well, imagine you’re at a party, and you decide to bring some chips to share with everyone. Now, let’s say you’re an end funds manager, and you decide to. The fund manager combines your end funds with other guests’ funds into one big bowl. Now, everyone can dip into those end funds whenever they want.

Similarly, when you buy shares in a mutual fund or closed-end funds, your money gets combined with other investors’ money to create a pool that professionals manage. These end fund managers use their expertise to invest in various securities according to the fund’s objective. As these underlying investments, such as end funds, go up or down in value, so does the overall value of your shares.

When those securities pay out dividends or interest, you get your fair share, too. Investing in end funds is like getting a slice of the birthday cake when it’s time to blow out the candles. The amount you receive at the end is based on the number of shares you own in the mutual fund.

One of the cool things about mutual funds is that they offer flexibility till the end. You can buy or sell shares anytime during regular trading hours, from the beginning to the end. It’s like having an all-you-can-eat buffet where you can return for seconds or leave at the end.

Types of Mutual Funds

Stock, Bond, and Index Funds

Stock funds are an investment option that generates long-term capital appreciation by investing in publicly traded companies’ equities. These funds aim to provide investors with a way to grow their investments over time. These investment funds allow investors to become part-owners of companies and potentially benefit from their growth over time, ultimately leading to a positive end.

On the other hand, bond funds focus on fixed-income securities like government bonds, corporate bonds, municipal bonds, and ends. These investments provide regular interest income to investors, making them a popular choice for those seeking a steady stream of cash flow in the end.

Index funds have gained popularity due to their aim to replicate the performance of a specific market index. By holding similar securities in the same proportion as the index they track, these funds offer investors an opportunity to invest passively and potentially earn returns similar to the overall market.

Choosing between stock, bond, or index funds depends on individual factors such as risk tolerance and investment goals. Investors should consider how comfortable they are with market fluctuations and whether they prioritize growth or income generation.

Specialty and International Funds

Specialty funds concentrate their investments in specific sectors such as technology, healthcare, energy, or real estate. These mutual funds cater to investors who believe specific industries will outperform the broader market. For instance, if you think technology companies will experience significant growth in the future, you might consider investing in a technology-focused speciality fund.

International funds allow investors to participate in foreign markets’ growth. They invest in securities issued by companies outside their home country. Alongside potential global diversification benefits, international funds also allow investors to benefit from currency fluctuations potentially.

However, it’s important for investors to be aware of additional risks associated with speciality and international funds. Sector volatility can impact speciality fund performance since it heavily relies on a particular industry’s success or failure. Similarly, geopolitical factors can significantly influence international fund returns due to political instability or economic changes in foreign countries.

Balanced and Money Market Funds

Balanced funds aim to achieve a balanced risk-return profile by allocating investments across stocks and bonds. These funds are suitable for moderate-risk investors who seek capital appreciation through equity exposure while also desiring stability through fixed-income investments.

On the other hand, money market funds provide stability of principal and liquidity. They invest in short-term debt instruments like Treasury bills or commercial paper with high credit quality and low risk. Investors often favour Money market funds seeking a safe parking place for their cash reserves.

Investing in Mutual Funds

Investing in mutual funds can be a smart move for anyone looking to grow their wealth and achieve specific financial goals. Whether you’re saving for retirement or funding your education, mutual funds offer a range of benefits that can help you reach your objectives.

When planning your investments with mutual funds, it’s essential to consider factors like risk tolerance, time horizon, and return expectations. These factors will guide you in selecting suitable mutual funds that align with your goals. Remember, not all mutual funds are created equal, so choosing ones that suit your needs is essential.

Diversification is key when building a well-rounded portfolio using different types of mutual funds across various asset classes. This strategy helps spread out the risk and potentially maximize returns. By investing in different sectors such as stocks, bonds, or even hybrid funds, you can protect yourself against market volatility and increase the likelihood of earning consistent profits.

Regularly reviewing the performance of your mutual fund holdings is crucial to ensure they are meeting your expectations. Rebalancing your portfolio periodically allows you to maintain the desired asset allocation and adjust for any changes in market conditions. It’s always wise to consult with a financial advisor or conduct thorough research before making investment decisions.

Now, let’s talk about browsing and investing strategies. Plenty of online platforms and financial institutions allow you to explore various options available in the market. These platforms often provide screening tools that allow you to filter mutual funds based on criteria such as expense ratio, performance history, or fund size.

Two common strategies used by investors are dollar-cost averaging and lump-sum investing. Dollar-cost averaging involves regularly investing fixed amounts into mutual funds regardless of market conditions. This approach averages out purchase prices over time and reduces the impact of short-term market fluctuations on your overall investment returns.

On the other hand, some investors prefer lump-sum investing, where they can deploy a significant amount into mutual funds at once. This strategy is often based on market analysis or timing considerations. However, it’s important to remember that timing the market can be challenging and comes with its own risks.

Now, let’s look at the investor services that mutual fund companies offer. These services aim to enhance mutual fund investors’ overall experience and convenience. Online account access allows you to view your portfolio holdings, transaction history, and statements through secure portals provided by these companies.

Pricing and Returns of Mutual Funds

Mutual Fund Pricing Explained

Mutual fund pricing can be confusing, but don’t worry; I’ve got you covered. The Net Asset Value (NAV) is the magic number that represents the per-share value of a mutual fund. It’s calculated by dividing the total net assets by the number of outstanding shares. Picture it like this: if you have a pizza and want to know how much each slice is worth, divide the total pizza value by the number of slices.

Now, here’s where it gets interesting. The NAV is usually calculated at the end of each trading day based on the closing prices of securities in the fund’s portfolio. It’s like taking a snapshot of all the investments in your mutual fund at that specific moment. So, if your mutual fund owns stocks, bonds, or other assets, their values will determine your NAV.

But wait, there’s more! Mutual funds may have different share classes with fancy names like Class A and B. Each class has its own expense structure, sales charges (or loads), or minimum investment requirements. Class A shares often have front-end sales loads, which means you pay a fee upfront when you buy into the fund. On the other hand, Class B shares may have contingent deferred sales charges (CDSC) if you sell them within a specific period.

Understanding mutual fund pricing helps investors assess costs and potential returns associated with their investments. It’s like peeking behind the curtain to see what makes your investment tick.

Calculating Mutual Fund Returns

You’re probably wondering how to measure whether your mutual fund is doing well or not. Well, my friend, let me introduce you to two essential metrics: total and annualised returns.

Total return considers capital appreciation (or depreciation) and income generated from dividends or interest payments. Imagine you invested $100 in a mutual fund, which has grown to $120 after a year. That $20 increase plus any dividends or interest you received during that period would be your total return.

To compare returns over different time periods, we use annualized returns. It’s like finding the average annual percentage growth rate of your investment. So, if your mutual fund had an annualized return of 10% over five years, it means your investment grew by 10% each year on average.

But hold on, there’s one more thing to consider: taxes!

Advantages of Mutual Funds

Diversification and Professional Management

Diversification is a fancy word for spreading your investments across different things. It’s like not putting all your eggs in one basket. And mutual funds are experts at diversification! They invest your money in lots of different things, like stocks, bonds, or even real estate. This way, you won’t lose everything if one investment doesn’t do so well.

Mutual funds work by pooling money from many investors to create a big pot of cash. Then, they use that cash to buy a bunch of different investments. So, instead of investing in just one company or industry, you get a nice mix of stuff. It’s like going to an all-you-can-eat buffet instead of ordering just one dish!

But here’s the best part: mutual funds have professional managers who make all the investment decisions for you. These folks are like financial superheroes! They spend their days researching and analyzing the market to find the best opportunities for your money.

Imagine figuring out which stocks to buy or when to sell them on your own—it can be pretty overwhelming! But with a mutual fund manager on your side, you don’t have to worry about making those tough choices yourself. They’re trained professionals who know how to navigate the ups and downs of the market.

And let’s face it—most of us don’t have enough time or expertise to do all that research ourselves. We’ve got other things going on in our lives! That’s why having someone manage our investments for us can be a huge advantage.

By relying on professional management, you access investment opportunities that might otherwise be out of reach. These managers have their fingers on the market’s pulse and can spot promising investments before they become popular among regular investors.

The goal here is simple: reduce risk and increase potential returns. By diversifying across different investments and having a pro at the helm, mutual funds aim to give you the best shot at making money. It’s like having a skilled captain steering your financial ship through stormy waters.

So, if you’re looking for a way to invest without all the stress and hassle, mutual funds might be just what you need. They offer diversification to protect your money and professional management to make those tough investment decisions on your behalf. It’s like having your own personal financial superhero!

Risks and Considerations

Understanding Fees

Mutual funds come with fees that investors need to understand before diving in. These fees are charged to cover various expenses associated with managing the fund. Let’s break down some key points about mutual fund fees:

- Expense Ratio: This represents the annual percentage of a mutual fund’s assets that are deducted as fees from shareholders’ investments. It covers operating expenses, administrative costs, portfolio management fees, and distribution charges. It’s important for investors to pay attention to expense ratios as they can impact overall investment returns.

- Sales Loads: Some mutual funds impose charges known as sales loads when buying or selling shares. There are two types: front-end loads and back-end loads. Front-end loads are charged when purchasing shares, while back-end loads are applied when selling them. Investors should be aware of these charges and consider their impact on investment performance.

- Transaction Fees: Transaction fees may apply when investors buy or sell mutual funds through brokerage platforms that charge commissions per trade. These fees vary depending on the platform and the specific mutual fund being traded. Investors must factor in transaction fees when considering their investment strategy.

Considering all these different types of fees is essential for selecting suitable mutual funds that align with an investor’s financial goals and risk tolerance.

Avoiding Fraud

While investing in mutual funds can offer potential benefits, it’s crucial to be aware of potential risks associated with fraudulent schemes in the industry. Here are some considerations for avoiding fraud:

- Thorough Research: Conduct thorough research before investing in any mutual fund or working with an investment advisor. Verify the legitimacy of any investment opportunity by checking if individuals or firms providing advice or managing assets are properly licensed and regulated by relevant authorities.

- Be Wary of Unsolicited Offers: Investors should exercise caution when approached with unsolicited offers promising high returns with little risk. It’s important to scrutinize unsolicited offers, personal information requests, or pressure tactics used by individuals claiming to represent legitimate mutual funds. If something seems too good to be true, it probably is.

- Report Suspected Fraud: If investors suspect fraudulent activities or encounter potential scams in the mutual fund industry, reporting these promptly to relevant regulatory bodies can help protect others from falling victim and prevent further fraudulent activities.

By being vigilant and informed, investors can minimize the risks associated with fraud in the mutual fund industry and make more informed investment decisions.

Transaction Tools for Investors

Smart Planners for Investments

Various online tools and calculators are available to assist investors in planning their investments using mutual funds effectively. These tools can be a game-changer for individuals looking to make informed investment decisions.

Investment planning tools provide valuable insights by helping determine an individual’s risk tolerance, set financial goals, estimate required savings amounts, or project future portfolio values based on different scenarios. They act as a guiding light, illuminating the path towards financial success.

Retirement planning calculators specifically cater to those who want to build retirement savings using a combination of contributions from various sources like employer-sponsored plans and individual retirement accounts (IRAs). With these calculators, you can envision your golden years and ensure you’re on track to meet your retirement goals.

Tax planning tools are another essential component of the investor’s toolkit. They help assess the potential tax implications of mutual fund investments and optimize tax strategies accordingly. By utilizing these tools, investors can navigate through the complex world of taxes and maximize their returns.

These savvy planners empower investors with knowledge, allowing them to make well-informed investment choices. Whether it’s determining how much risk they are comfortable with or understanding the impact of taxes on their returns, these tools provide valuable insights that shape investment decisions.

Transaction Calculators Explained

Mutual fund transaction calculators are crucial in estimating the impact of fees, loads, or other charges on investment transactions. These calculators give investors a clear picture of the financial implications of buying or selling mutual funds.

By inputting details such as investment amount, sales load percentage, or redemption fee structure into these calculators, investors can determine the actual cost or proceeds from a transaction. This transparency ensures there are no surprises.

Their ability to compare different scenarios makes transaction calculators even more powerful. Investors can adjust variables like holding periods, reinvestment options, or anticipated returns to evaluate potential outcomes. This feature allows investors to make informed decisions by considering various factors that impact their investment journey.

Understanding the costs associated with transactions is crucial for investors. By using transaction calculators, they can assess the financial implications of buying or selling mutual funds before making any actual investment decisions. Armed with this knowledge, investors can align their choices with their overall investment strategy and make calculated moves in the market.

Advanced Learning in Mutual Funds

Detailed Investment Strategies

Different mutual fund investment strategies cater to various investor preferences and objectives. One popular strategy is value investing, which involves identifying undervalued securities with the potential for long-term appreciation based on fundamental analysis. This means looking at a company’s financial health, earnings potential, and market position to determine its worth investing in. On the other hand, growth investing aims to identify companies with high growth potential that may outperform broader market indices over time. Investors who follow this strategy are looking for stocks of companies that are expected to experience significant earnings growth in the future.

Another investment strategy is income investing, which emphasizes generating regular income through dividends or interest payments from fixed-income securities held within a mutual fund’s portfolio. This strategy is often favoured by investors who rely on their investments as a source of income or those seeking stability and consistent returns.

Sector rotation is another approach used by some mutual fund managers. It involves shifting investments between different sectors based on economic cycles or sector-specific trends to capitalize on potential opportunities. For example, during an economic downturn, a manager may reduce exposure to cyclical industries like manufacturing and increase holdings in defensive sectors like healthcare or consumer staples.

Tactical asset allocation strategies involve adjusting portfolio allocations based on short-term market conditions and outlooks. Fund managers using this strategy, actively monitor market trends and make changes accordingly to take advantage of short-term opportunities or manage risks.

Update Details for Investment Adjustments

Investors should regularly review and update personal information associated with their mutual fund investments. This includes contact details such as address, phone number, and email address. By keeping this information up-to-date, investors ensure they receive timely communication from mutual fund companies regarding statements, distributions, or important notifications related to their accounts.

Beneficiary designations should be reviewed periodically to ensure they align with an individual’s current estate planning goals and intentions. Life events such as marriage, divorce, or the birth of a child may warrant changes to beneficiary designations. It’s essential to ensure that the intended beneficiaries are correctly listed to avoid any complications in the future.

Investors may need to update bank account information for electronic fund transfers, dividend reinvestments, or redemption proceeds. This ensures smooth transactions and prevents any delays or issues with receiving funds.

Promptly notifying mutual fund companies of any changes in personal details helps maintain accurate and up-to-date investor records.

Other Investment Solutions

Exploring Alternatives to Mutual Funds

While mutual funds offer several advantages, such as diversification and professional management, it’s essential for investors to consider alternative investment options that align with their specific preferences or circumstances. Here are some alternatives worth exploring:

Exchange-traded funds (ETFs)

Exchange-traded funds (ETFs) are similar to mutual funds but trade on stock exchanges like individual stocks. This means they provide intraday liquidity, allowing investors to buy and sell shares throughout the trading day. ETFs may offer potential tax advantages due to their unique structure.

Individual Stocks

Investing in individual stocks allows you to directly own shares of specific companies instead of investing in a diversified portfolio through mutual funds. This approach gives you more control over your investments and the opportunity to participate in the success of individual businesses.

Real Estate Investment Trusts (REITs)

For those interested in exposure to the real estate market, Real Estate Investment Trusts (REITs) can be an attractive option. REITs invest in income-generating properties such as commercial buildings or residential complexes, providing investors with a way to benefit from real estate without the need for direct property ownership.

Certificates of Deposit (CDs), Bonds, or Money Market Accounts

Conservative investors seeking low-risk fixed-income investments may find Certificates of Deposit (CDs), bonds, or money market accounts appealing. These options provide stability and consistent returns by offering a predetermined interest rate over a fixed period of time.

When considering these alternatives, it’s crucial for investors to evaluate their risk tolerance, investment goals, and time horizon. Each option comes with its own set of benefits and considerations.

Conclusion

Congratulations! You’ve reached the end of our journey into the world of mutual funds. Throughout this article, we have explored the various aspects of mutual funds, including their types, advantages, risks, and considerations. We have also discussed how to invest in mutual funds, analyze pricing and returns, and explore advanced learning opportunities.

By now, you should understand mutual funds and how they can fit into your investment strategy. Whether you’re a novice investor looking to grow your wealth or a seasoned investor seeking diversification, mutual funds offer a convenient and accessible option.

Now that you have this knowledge at your fingertips, it’s time to take action. Start by evaluating your financial goals and risk tolerance. Consider consulting with a financial advisor who can help you navigate the vast landscape of mutual fund options. Remember, investing involves risk, so it’s essential to make informed decisions based on your individual circumstances.

So go ahead and embark on your investment journey with confidence. Explore the world of mutual funds and watch your wealth grow over time. Happy investing!

Frequently Asked Questions

What is a mutual fund?

A mutual fund is an investment vehicle that pools money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. It offers individual investors the opportunity to access professionally managed portfolios with ease.

How do mutual funds work?

Mutual funds work by collecting money from individual investors and using it to buy a diversified mix of assets. Professional fund managers make investment decisions on behalf of the investors, aiming to generate returns and manage risks according to the fund’s objectives.

What are the advantages of investing in mutual funds?

Investing in mutual funds offers several advantages. It provides diversification, as your money is invested across various securities. Mutual funds also offer professional management expertise, liquidity for easy buying and selling, and accessibility for small and large investors.

Are there any risks involved in investing in mutual funds? What are the risks of the investment approach and investment objectives of unit investment trusts? What are the risks of the investment approach and investment objectives of unit investment trusts? What are the risks of the investment approach and investment objectives of unit investment trusts?

Yes, investing in mutual funds carries certain risks. The value of your investment can fluctuate based on market conditions, potentially resulting in losses. Some funds may have specific risks associated with their underlying investments, such as stock market volatility or interest rate changes.

How can I choose the suitable hybrid or bond funds for my investment objective and investment approach?

To choose the right mutual fund for you, consider factors like your financial goals, risk tolerance, investment time horizon, and desired asset allocation. Evaluate the fund’s performance history, fees and expenses, investment strategy, and manager’s track record. Consulting with a financial advisor can also be beneficial.